The curve shown combines the production possibilities curves for each plant. At point A, Alpine Sports produces 350 pairs of skis per month and no snowboards. If the firm wishes to increase snowboard production, it will first use Plant 3, which has a comparative advantage in snowboards. This article explored the concept of production possibility, the graphical representation through the Production Possibility Curve (PPC), and strategic considerations for decision-making. Here, an economy that can produce two categories of goods, security and “all other goods and services,” begins at point A on its production possibilities curve.

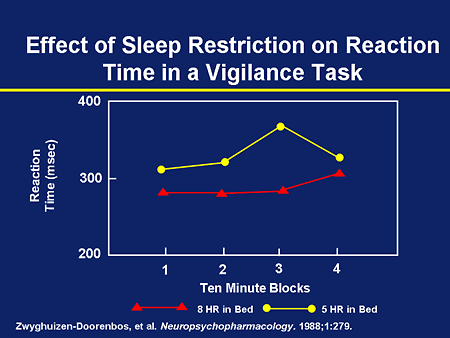

We assume that the factors of production and technology available to each of the plants operated by Alpine Sports are unchanged. Making smart decisions is important to avoid increasing opportunity cost over time. Evaluate whether your situation fits into the law of increasing costs examples of the constant opportunity cost graph to decide what will be best not only in the short-term but for your future steps as well. Moving along the PPC implies reallocating resources from one good to another. The opportunity cost increases as resources shift from producing one good to the other. This phenomenon arises due to the principle of diminishing returns.

Grappling with Trade-Offs in Resource Allocation

It is the amount of the good on the vertical axis that must be given up in order to free up the resources required to produce one more unit of the good on the horizontal axis. We will make use of this important fact as we continue our investigation of the production possibilities curve. The production possibilities frontier (PPF) is closely related to opportunity cost.

This opportunity cost equals the absolute value of the slope of the production possibilities curve. To see this relationship more clearly, examine Figure 2.3 “The Slope of a Production Possibilities Curve”. The segment of the curve around point B is magnified in Figure 2.3 “The Slope of a Production Possibilities Curve”.

The economy is experiencing full employment (everyone who has to work has a job), the best technology is being used and production efficiency is being maximized. So the question becomes, what is the cost of producing more oranges or cars? If the economy is at the maximum for all inputs, then the cost of each unit will be more expensive.

Comparative Advantage and the Production Possibilities Curve

Under the law of increasing opportunity cost, as an economy redirects its resources from producing one good to another, there is typically an escalation in the cost of producing the second good. This principle underscores the notion that dedicating a more significant portion of resources to producing a particular good reduces the suitability of those resources for manufacturing alternative goods. By recognizing the relationship between opportunity cost and production possibility, individuals and economies can make well-informed choices that optimize efficiency and output. Some business owners and managers use a visual tool called a production possibilities frontier (PPF) to calculate opportunity cost. This can help business owners understand the consequences of their decisions when using limited resources such as labor and raw materials.

Six hot opportunity areas to beat the heat through federal policy – fas.org

Six hot opportunity areas to beat the heat through federal policy.

Posted: Sun, 13 Aug 2023 07:00:00 GMT [source]

Imagine a farmer who owns a plot of land and has to decide how to allocate the resources between growing wheat and cultivating corn. The company can assess each choice’s potential benefits and drawbacks by evaluating the opportunity costs of each option. This analysis enables the company to make a more informed decision by considering the potential gains and losses tied to different resource allocation strategies within the confines of its limited budget. A production possibilities curve (PPC) is a model that captures the scarcity and opportunity costs of a choice when faced with the possibility of producing two goods or services. Every time we commit more of our company’s resources in a particular direction, we will run into the law of increasing opportunity costs.

How the Specialization of Labor Can Lead to Increased Productivity

In essence, placing more emphasis on producing specific products results in a higher cost for the alternative goods that must be forgone. This law remains valid due to the finite adaptability and limitations of resources. The first resources reallocated to making puzzles are those that were not well suited to make baseballs. However, as you continue to increase puzzle production, you start reallocating resources that were better at making baseballs than puzzles. Therefore, the cost to make one more puzzle is at the loss of more baseballs than with the first set of resources that were allocated. When making all baseballs, there are some resources that would be more efficient if allocated to producing the other good.

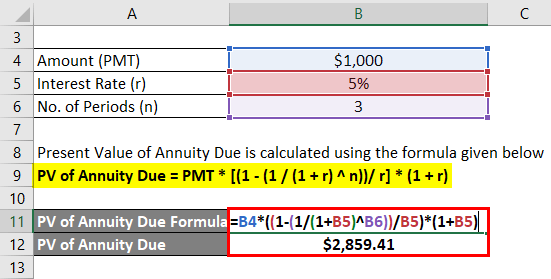

- The table in Figure 2.2 “A Production Possibilities Curve” gives three combinations of skis and snowboards that Plant 1 can produce each month.

- Implicit costs are intangibles like time and mental energy that can only be allocated to one thing at a time.

- Investing in these resources can help you scale up production, but it increases your opportunity cost by leaving you with less to invest in other initiatives.

- We will see in the chapter on demand and supply how choices about what to produce are made in the marketplace.

In fact, each decision you make that locks you into one course of action diminishes your ability to do other things. Here’s an overview of the law and an explanation of how it can affect you as a small business owner. So you start to move off the end point and make a combination of baseballs and puzzles. With each additional puzzle you make, there is an opportunity cost of giving up baseballs. As the law of increasing opportunity cost states, the cost of producing the additional puzzle increases as you move along the PPF.

Cost, Time and Effort

So it is very important that we make the right choices about what we have. On the other hand, if you put it on the sales floor and the warehouse is cluttered, you may lose other sales because your employees can’t find the product that customers want to buy. The law increases access to lower cost clean energy and improves energy efficiency, expands climate-smart agriculture and conservation while creating good paying jobs. The legislation also protects communities from the increasing risks of wildfires and extreme heat. Make sure you deploy those resources with the smallest opportunity cost, i.e., with the greatest return.

The economy will have to incur more variable costs, such as overtime, to produce the unit. The Law of Increasing Opportunity Costs says that, as we produce more of a particular good, the opportunity cost of producing that good increases. The main reason for this is the fact that not all resources are created equal. Some resources are better than others for producing certain goods (or services).

By buying the computer, you’re giving up the chance to do something else with that $1,000. The the total cost of using something the highest cost of the best alternative use, says The Library of Economics and Liberty. Finding the best use for money is often an exercise in identifying the use that carries the lowest opportunity cost. However, in accounting, opportunity costs are not recognized as product costs or business expenses.

The table shows the opportunity cost of each pair of points on the chart to see the law in an example. Talking through the first move from Point A to Point B, you start off making 59 baseballs and five puzzles. You increase puzzle production by one, but have to give up two baseballs (Point B). You can use this same logic to see how the opportunity cost of all the point pairs was determined. As you can see in the table, the calculated opportunity cost increases as you decrease baseball production and start increasing puzzle production. The law is best explained along with a graphical representation of the production possibility frontier, also known as the PPF.

In the meantime, start building your store with a free 3-day trial of Shopify. Get free online marketing tips and resources delivered directly to your inbox. The rising cost principle also applies to personal finance, where people make economic decisions motivated by self-interest to ensure personal profitability. If you assign an employee to tidy up the warehouse instead of helping customers, it could cost you several sales because some customers will not be helped and will leave without buying anything. Since President Biden signed the law one year ago, the Inflation Reduction Act has given the U.S. Department of Agriculture (USDA) resources to better serve every American.

Specialization implies that an economy is producing the goods and services in which it has a comparative advantage. If Alpine Sports selects point C in Figure 2.8 “Efficient Versus Inefficient Production”, for example, it will assign Plant 1 exclusively to ski production and Plants 2 and 3 exclusively to snowboard production. The increase in resources devoted to security meant fewer “other goods and services” could be produced. In terms of the production possibilities curve in Figure 2.6 “Spending More for Security”, the choice to produce more security and less of other goods and services means a movement from A to B.

Constructing a Production Possibilities Curve

Factors that can have an impact on production costs include raw materials, vendor services, employee salaries, machinery, real estate, shipping, and regulatory and licensing fees. Investing in these resources can help you scale up production, but it increases your opportunity cost by leaving you with less to invest in other initiatives. To understand the law of increasing opportunity costs, let’s first define opportunity costs. Opportunity cost is the cost of what you are giving up to do what you are currently doing. If you can either go to work or go to the beach, and you choose to work, the opportunity cost of working is the value you would have gotten had you gone to the beach.

Could an economy that is using all its factors of production still produce less than it could? An economy achieves a point on its production possibilities curve only if it allocates its factors of production on the basis of comparative advantage. The production possibilities curve shown suggests an economy that can produce two goods, food and clothing. As a result of a failure to achieve full employment, the economy operates at a point such as B, producing FB units of food and CB units of clothing per period. Putting its factors of production to work allows a move to the production possibilities curve, to a point such as A. The table shows the combinations of pairs of skis and snowboards that Plant 1 is capable of producing each month.

That was a loss, measured in today’s dollars, of well over $3 trillion. In material terms, the forgone output represented a greater cost than the United States would ultimately spend in World War II. Output began to grow after 1933, but the economy continued to have vast numbers of idle workers, idle factories, and idle farms.

By 1933, more than 25% of the nation’s workers had lost their jobs. The economy had moved well within its production possibilities curve. Opportunity costs exist because of the fact of limited resources, says Shopify. Smart business owners and managers take stock of the resources they have at their disposal and deploy them to ensure the greatest return – that is, to minimize the opportunity cost. It rises – slowly at first, but more rapidly later on as you apply resources to tasks for which they’re ill-suited and leave other areas neglected. In decision-making, it is crucial to balance short-term gains and long-term consequences.